A Guide to Northeastern's Graduate School Scholarships

June 26, 2024

Learn how grad school scholarships, fellowships, and other forms of aid can help you pay for your advanced degree.

By Shayna Joubert

July 15, 2024

Earning a graduate degree is a great way to advance your career, improve your skill set, and increase your earning potential. However, many people are concerned about the affordability of an advanced education.

Most graduate schools have an array of financial aid options, such as scholarships, grants, and work-study. If these options aren’t enough to cover the cost of graduate school, however, don’t despair. If you’re currently employed, then you might be eligible for tuition reimbursement. Approximately 48% of employers offered tuition assistance as a benefit in 2022.

Here’s an overview of tuition reimbursement and how you can effectively use it to fund your advanced education.

Tuition reimbursement (also known as tuition assistance) is an employee benefit through which an employer pays for a predetermined amount of continuing education credits or college coursework to be applied toward a degree. These programs are intended for employees hoping to advance their education as it relates to their current career track, offering the chance to increase their industry knowledge and develop advanced skills.

These benefits are widely available, although underutilized. U.S. companies spend about $28 billion annually on educational assistance programs. However, only 2% of eligible employees take advantage of tuition assistance programs, and approximately 60% of working professionals are unaware of their employer’s benefits.

On average, companies spend somewhere around $10,500 for employees pursuing graduate degrees, although organizations are beginning to increase their educational benefits as they see the positive impact they can have on their business. Some companies prepay for students’ coursework, which can encourage participation in their tuition reimbursement program. These programs vary, however, so it’s crucial that you review the program details before assuming your college coursework will be fully covered. You may have to foot the bill upfront and submit a request for reimbursement in accordance with your employer’s tuition assistance policy.

While specific program policy details differ by organization, here are a few commonalities to keep in mind.

Tuition reimbursement programs often come with employee and coursework eligibility requirements. Your employer’s program eligibility requirements may differ from the samples provided here.

Tuition reimbursement programs offer clear benefits to employees looking to upskill and advance. Those who take advantage of these programs know they can turn their employer’s financial support into a graduate degree that will carry them the rest of their professional career. But what’s in it for the employer?

Many companies around the world (including at least 25 major employers in the Boston area) understand the value of tuition reimbursement programs and actively use them as a tool to recruit new talent.

Here’s a list of tuition reimbursement program benefits for employers:

While the most apparent benefit of employee tuition reimbursement is the additional source of college funding that’ll reduce your reliance on student loans, some other benefits can’t be measured in dollars and cents. Tuition reimbursement benefits employees in several key ways, including:

Take advantage of your company’s tuition reimbursement program by contacting the human resources department and following the steps below.

You’ll want to identify any program requirements and limitations before you enroll in classes. Even if your employer has not entered into a training agreement with an educational institution, there may be restrictions on which educational credits qualify for reimbursement. For example, college credit completed at a community college may be eligible while coursework completed at a local private postsecondary institution may not be.

Let your HR representative know that you plan to pursue a graduate degree. They can assist you with getting the most out of your company’s tuition reimbursement program.

In most cases, prior approval is required from your employer before enrollment. You’ll also want to confirm whether your employer requires you to remain employed for a specified period after the course is completed. Make sure you check with HR so you’re not left with unexpected tuition obligations.

Some employers may also require you to complete a Free Application for Federal Student Aid (FAFSA) before submitting a request for reimbursement. This encourages employees to exhaust other options before applying for tuition reimbursement. It’s important to clarify these details beforehand.

Make sure you submit the required paperwork to your employer before classes begin. Once classes are completed, ensure the necessary documentation for reimbursement is processed promptly.

Keep in mind, your current employer may not advertise the availability of their program, so be sure to connect with your human resources department today. Even companies without formal tuition reimbursement programs may consider offering this perk if you can convince them of the benefits.

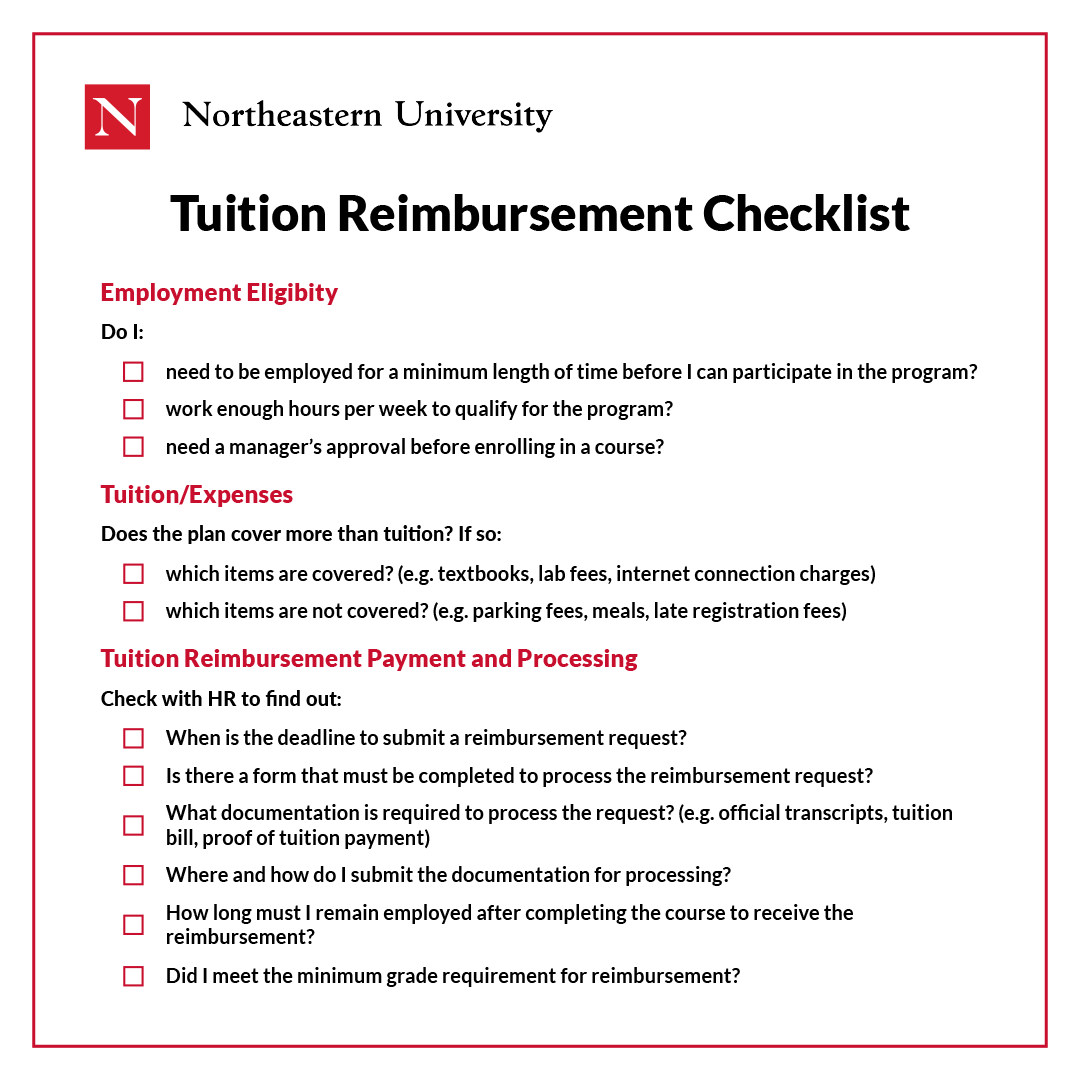

The only way to take full advantage of this employee benefit is to understand your employer’s participation requirements. Use the following checklist to get the most out of your employer’s tuition reimbursement program:

You can obtain your graduate degree by tapping into all available funding sources, including federal student aid programs, scholarships, and state grants. Consider your overall graduate school financing plan and how it aligns with your employer’s tuition reimbursement policy.

If you can reduce the cost of going back to school by exhausting the annual limits of your company’s tuition reimbursement program, this benefit may hold the financial key to completing your degree.

Editor’s Note: This post was originally published in March 2024. It has since been updated for relevance and accuracy.

Explore our financial aid options, or connect with our team to receive personalized advice today.

Explore our financial aid options, or connect with our team to receive personalized advice today.

June 26, 2024

Learn how grad school scholarships, fellowships, and other forms of aid can help you pay for your advanced degree.

April 29, 2024

With a little time, research, and creativity, you can fund your dream of going to grad school. Find out how.

July 2, 2024

Many employers offer tuition reimbursement programs for employees. Here are 8 companies that pay for grad school.